Resources

Lessons in this beginners forex trading course

- Learn forex trading course

- Introduction to the Forex Market

- Currency pairs – Understanding and reading forex quotes

- Forex pips and lots

- Margin trading and leverage accounts

- Major currencies and currency types

- Forex analysis – Analyzing the Forex market

- Forex fundamental analysis

- Forex technical analysis

- Summary – Forex analysis

- Trading styles

- Forex day trading

- Forex swing trading

- Forex scalping

- Conclusion – Which style should you choose?

- Technical analysis

- Resistance and support

- Price action: Chart patterns and price formation

- Technical indicators

- Fundamental analysis

- Gross domestic product (GDP)

- Producer price index (PPI)

- Consumer price index (CPI)

- Commitment of traders – The COT reports

- Summary – Fundamental analysis

- Trading Psychology

- Overleveraging – the risks of forex leverage

- Undercapitalization

- Money management

- How to become successful in trading forex

- Getting started – Choose a forex broker and the right kind of account

Learn Forex Trading Course

Published:Updated:

With Our Comprehensive Forex Beginner’s Course

Welcome to our forex trading course. If you feel like you’re a penguin in the desert when reading about forex trading, don’t worry, our forex course is here to guide you and help you through your journey in the kingdom of money.

Our forex education aims to introduce the trader to the basics of how to trade forex. Nobody wants to have a brutal freshman experience as he takes his baby steps to a new activity. By enlightening the new trader as to what he shouldn’t do in the markets, we aim to minimize the birth pains of his budding career. The new trader can expect to find a no-nonsense discussion of the various pitfalls and dangers associated with currency trading in these pages, but he will also find a good deal of advice on what he should do: study, be patient, be humble, and don’t gamble.

Updated:

Introduction to the Forex Market

Published:Updated:

Many of us have been fascinated by the shiny, colorful world of currencies as children, and even those of us who have little interest in the forex market have engaged in some form of currency trading while traveling outside their homeland. And these days, one will easily find people discussing the advantages and weaknesses of the US dollar even in a casual gathering.

The forex market is the currency market: it’s where the value of each currency is determined versus every other currency in the world. If you exchange one US dollar for its equivalent value in Euros, you’re already a part of the forex market, and are creating the quotes you see reported on TV screens every day. There’s no difference between the actions of a tourist at an exchange bureau, and the transactions of banks in the international market, apart from size and maturity terms.

In today’s integrated and specialized economies it’s rare to find all the components of any product produced inside one country’s borders, and so, international trade is a major creator of global forex volume. Deepening financial interactions across the globe through partnerships, buyouts of firms and international loans, along with ever complex tools of investment have been increasing the size of the forex market in recent years. If global trade and finance were the body of world economy, the forex market would be the circulatory system; in other words, there doesn’t exist a deeper, more liquid market than that of currency trading. Almost every political or economical event of long-term significance is reflected in its workings, and understanding it results in a very good comprehension of finance and economics in general.

Participating in such a vast and significant mechanism can be a rewarding and exciting experience for the individual investor. But while this is true, success during your interactions with the giants will require more than a bit of diligence and patient study. The rewards can be immense: famous investors such as George Soros, Jim Rogers, large Wall Street firms such as Goldman Sachs, or banks like Citibank all make millions of dollars each year from trading in the forex market. In fact George Soros is notorious as being the man who broke the Bank of England: Through successful speculations, he was able to make 1 billion dollars in just about a week.

Updated:

Currency Pairs – Understanding and Reading Forex Quotes

Published:Updated:

Our first grade in forex literacy is for understanding how to read the price quote. In forex, currencies are always quoted in pairs. In other words, it’s only possible to value a currency in terms of another one. If you want to buy 100 Euros, how are you going to pay for it? If you were to pay in euros, you’d not be currency trading, and when you use another currency to fund your purchase of the euros, you’re actually creating a forex quote.

It’s actually quite easy to evaluate forex quotes once you get the hang of it, and the fastest way to learn is by considering some examples:

EUR/USD 1.2786

So what does the above quote tell us? What it says is that 1 Euro is able to buy 1.27 units of the US currency. Or, continuing on our previous transaction, we would have to pay

127 USD for 100 Euros we wanted to buy.

But in fact this value is only the average of the bids (price to buy) and offers (price to sell) for a currency pair at a particular time. The bid-ask spread is usually very low for the most liquid pairs, such as the EUR/USD, but at times of illiquidity in the markets, as before a statistical news release, or a central bank decision, the spread can widen to much greater levels.

The quote represents the best pricing that the world market offers for a currency pair at a particular moment. A quote on a computer does not usually include all of the offers and bids all over the world, but because of the very liquid nature of the forex market, any significant difference in quotes across different parts of the world is very quickly eliminated through computer-based, automatic arbitrage, and consequently, except at times of market turmoil the difference between regional quotes is quite low.

So let’s say return to the EUR/USD quote. Our quote is at 1.2786, and the bid-ask spread is at 0.009, as stated by the broker. What this means is that there’s a difference of 0.9 cent between what you pay to buy the same currency pair, and what you’d receive if you were selling it. There’s always a spread in even the most liquid markets, but the spread is usually widened further by the brokerage firm, so that it can make a profit from the individual traders’ deals.

The important point to keep in mind when evaluating quotes is that one quote is valid for only a fraction of a second. At times of market tension, great fluctuations can occur within the scope of one minute, rendering the quote almost useless. Despite the great focus on prices and price patterns among many traders, it’s always advisable to keep the time of the day, of the year, and the emotional atmosphere of the market in mind while deciding on what we should do about a particular quote. For example, quotes during the last few weeks of the year, or in the Thanksgiving week, or at about an hour before the opening of the US market have far less value in determining future price direction and trends than those seen during an ordinary business day at regular hours. So, to repeat, the trader must not only know the price quote at a given moment, but also the seasonal, hourly, and emotional backgrounds that influence the quote before he decides to make a trade on the information.

That skill can be gained through practice, and is perhaps easier learned through experience than reading.

Updated:

Updated:

Forex Pips and Lots

Published:Updated:

A pip is the smallest amount of movement a price quote can make. In other words, each tick of the price quote is a pip. When EUR/USD moves from 1.2786 to 1.2787, for example, it has moved by one pip. You could also call it a point or a tick, but in forex traders’ jargon, pip is the word.

It’s a good idea to measure your profit or loss in pips rather than in the amount you actually lose or earn, since the trader’s performance can only be valued through his success in gathering pips. For instance, supposing trader A has a beginning capital of 100 USD, and trader B has only 10, it would take trader B ten times as much in terms of pips to achieve the same gain that was acquired by trader A in absolute dollar terms. In terms of their prowess in the market, however, if trader B were to make just 1/10 of what trader A makes, they’d still be equal, due to the the difference between their starting capital. This same logic can be utilized when assessing one’s own prowess, and if a diary is kept, it’s always better to note the loss or profit in pips, rather than cash, so as to keep a better track of performance.

It must also be remembered that one pip in the currency pair that is traded may not be the same amount in the trader’s base currency, that is, the currency with which he funds his account. For instance, if your currency is the British Pound, and you’re trading the EUR/USD, one pip movement in the currency pair would be a different amount in your base currency, depending on the quotes.

Another important term in trading forex is the lot, which is the smallest amount of currency you can trade at a particular level of leverage, and the standard lot size is 100,000 USD. Among today’s forex brokers, there are those who allow traders to enter bids without the use of lots (sometimes called mini lots), and the inexperienced trader may seek them before gaining enough confidence to start trading with a higher volume.

Margin Trading and Leverage Accounts

Published:Updated:

It’s very important that the trader gain a good grasp of these two concepts before engaging in any deals, because leverage and margin determine the lifespan of any trading account in a far more decisive manner than either technical or fundamental analysis.

Margin trading is trading with borrowed funds, and is closely related to leveraging. The broker allows the trader to control a far greater amount of money in the market in exchange for a small deposit of funds, with the understanding that the sum borrowed must be returned in exact amount, with any losses or profits returned to the account of client (the trader).

The amount that the client can control is determined by a number called the leverage ratio, and even the occasional observer can notice this number being proclaimed loudly by brokers in the advertisements that they scatter everywhere online. It’s not that difficult to grasp what the leverage ratio does: it simply multiplies the trader’s potential losses and gains in the market by the specified amount. For instance at a leverage ratio of 1/100, the client (you) will be able to control 100,000 USD which makes a standard lot, for a deposit of a mere 1,000 USD, and every single pip gain or loss will be multiplied a hundred times. To put this in a better perspective, you need a movement of just 1% in the price quote before your account is doubled — or wiped out. (Leverage over 50:1 for majors and 20:1 for minors is not available to traders in the U.S.)

One will often come across notices on broker websites making the claim that leverage is a double-edged sword; that you can both lose and gain massively depending on what you do. But high leverage, for sure, is a sword with only one edge, and we will discuss why it is so later.

Back to the beginning of the forex course.

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Major Currencies and Currency Types

Published:Updated:

There are a lot of nations in the world and consequently a large number of currencies to choose from when trading. The currencies of Brazil, Russia, China, the Eurozone, Turkey, Japan, South Africa and Canada are popular with large and small traders, for different reasons. What the market values most in a trade can change depending on government policies and the global economic environment. For example, during the flowery days of the carry trade, many traders would simply long (buy) the currency offering the highest interest rate, and short (sell) the one offering the lowest interest rate, with little consideration given to the underlying economic soundness. Such a strategy is less likely to be profitable in today’s chaotic environment with interest rates racing lower across the globe, and fundamental economic strength is once again the major concern in deciding on currency allocations.

In order to simplify the matter, let us group the currencies into four types and examine each of them briefly:

Reserve Currencies

There’s really only one true reserve currency in the world with dominance of about two-thirds of central bank accounts, and it is the US dollar, the currency of international trade. But there are also others, such as the Swiss Franc, Japanese Yen and to a greater extent, the Euro, which play the same role, and as such are of higher quality and offer greater safety in times of trouble.

Commodity Currencies

These are currencies of nations with a heavy dependence on commodity exports, such as the Canadian and Australian dollars or the Brazilian real, and their performance is closely related to the performance of the global commodity markets.

Exporter Currencies

These are currencies of the likes of Singapore, Malaysia, Taiwan, or China — although it’s difficult to trade the Ren Min Bi (RMB) due to capital controls — with healthy external trade surpluses. These nations often have a high private and corporate savings ratio, and are better placed to survive periods of financial difficulties as they have little need for external borrowing. As exporters, they will most often choose to keep their currencies priced lower against competitors to keep their products more competitive in the global markets.

High risk, high deficit, high yield currencies

In analogy with the bond market, one could also term these currencies junk currencies, in that the economies are usually dependent on external financing, with greatest domestic activity concentrated in real estate, finance, and tourism-related industries. Many emerging markets are members of this group, but there are also other, relatively advanced nations such as (alas!) the UK, or Iceland, which nowadays can be considered to belong to this category. Further examples would be Turkey, Romania and Hungary — as a group, they have suffered the worst of the troubles of 2008.

What use is this categorization to the trader? It’s mainly for those who want some diversification in their currency portfolios, in accordance with the ancient wisdom of not putting all eggs in the same basket. The above categories suggest that good diversification cannot be achieved by, for example, allocating long positions to both the Turkish lira, and the Romanian leu in the same account, as both of these currencies share the junk status. Nor can the trader claim to diversify his positions by buying the Brazilian real, and selling both the Swiss franc and the Japanese yen to fund the purchase. Both the franc and the yen are exporter currencies, and they are likely to make similar moves in response to financial developments. Forex brokers and websites sometimes offer correlation charts (which depict the price relationship between currency pairs during a specific time period), and the interested reader can learn more on this subject by studying them. But in general, positions in different currencies in a single category are likely to react like a single position of a single currency to market events; the trader should always keep this in mind when managing his account.

Major currencies

- USD – U.S. Dollar

- EUR- European Union Euro

- JPY- Japanese Yen

- GBP – U.K. Pound Sterling

- CHF – Swiss Franc

Forex Analysis – Analyzing the Forex Market

Published:Updated:

So we know what the forex market is, and we know what we want to do with it: We want to make money. How do we make money? In this part of the forex course we will learn to understand forex analysis. See also forex technical analysis.

Forex analysis is the tool with which people aim to make sense of the seemingly random developments in a typical day’s price action. Without analysis, all we’d have is a massive list of price quotes that’s updated on our screens every single second, and there would be no way of making any sense of it.

As with every other event in nature, developments in the currency market manifest themselves through cause and effect which are analyzed through the two branches of forex analysis: fundamental and technical. One problem people often have when studying forex analysis is failing to understand that price action is the result of a series of events that are independent of the price action itself. In other words:prices do not cause prices. The study of those economic and political factors which cause price movements is called fundamental analysis. Prices do, however, create patterns (such as head and shoulders, triangles, double tops or bottoms, etc.), the study of which is the subject of technical analysis.

What causes prices to move in a particular direction? Obviously this is the most important question that one must have answered in order to make a profit in currency trading. Major geopolitical and economic events undoubtedly create the powerful, long lasting undercurrents in the forex market. But, there are factors such as daily trade flows, cross-border mergers, currency options expiration-related activity, and other psychological factors which distort the underlying picture for those who are not very familiar with currency trading.

But let’s first briefly examine the two types of analysis that we just mentioned, before returning to the subject of the previous paragraph.

Forex Fundamental Analysis

Published:Updated:

As we mentioned before, prices do not cause prices. The reasons that lie behind price movements in the forex market are the subject of fundamental analysis, and those familiar with trading stocks should have little trouble in becoming familiar with fundamental analysis of currencies. Just as stock traders measure the health of a publicly-traded company by examining its balance sheet, indebtedness and cash flow statistics, the forex trader decides on the soundness of a nation’s economy by considering such things as central bank interest rate differentials (which is the difference between the borrowing costs as decided by the central banks of different countries), trade surplus or deficits, along with employment trends, productivity, and a number of other factors. When you set out to learn forex trading it is important to understand that fundamental analysis and technical analysis is two different ways of analysing the trade. Technical analysis argue that aspects affecting the currencies in fundamental analysis is already encompassed in the price movement.

Fundamental analysis states the causes of major price movements in a straightforward and clear manner. For instance, because of the ease of borrowing and the resultant abundance of global liquidity in recent years, the interest rate differential between two nations’ central banks has been the most important indicator in determining price trends in the forex market. While this is unlikely to remain so in today’s difficult environment, interest rates will remain one of the most important drivers of currency market trends for as long as financial actors are free to move capital across national borders.

Fundamental analysis attempts to discover and predict the causes of forex trends, and in doing so it uses a number of indicators to present a comprehensive picture of global finance. But beyond the indicators themselves, what really causes a currency pair to move in a particular direction? Are currency movements really decided by statistics and news flow only?

This question brings us to another definition of fundamental analysis: Fundamental analysis attempts to predict money flows into and out of a particular currency. Statistics are significant only as far as the markets regard them as a basis for directing cross-border money flows. A nation can have very low unemployment, a high current account surplus, excellent productivity rates, and very good statistics in general, and its currency can still do poorly against others – if, despite all those advantages, there’s a greater supply of it with respect to total demand. In other words, no indicator, no statistic or standard is enough to magically appreciate a currency versus another, if the general economic environment (i.e. the financial markets in general), is unwilling to make use of the advantages that a sound and healthy economy provides.

Later we will return and take a deeper look at fundamental analysis.

What is the strength of fundamental analysis?

The strength of fundamental analysis lies in its ties with economic events at the root level. It is relatively straightforward about its descriptions, and its rules and principles are often simple and easy to understand. And, the fact that fundamental causes decide the major trends in forex markets is indisputable. The trader possesses a very reliable tool in this kind of analysis. The problem with fundamental analysis, on the other hand, is twofold: it’s very poor as a timing indicator; and markets do not always react to its dictates in a rational manner. What must be remembered when the market value of a currency is a lot different from its fundamental value, is that the market would not have tolerated an irrational quote if some people somewhere were not making a great profit from that irrationality. It is therefore imperative that the analyst identify the abnormality, examine the causes of it, and formulate a strategy to exploit the discrepancy.

If fundamental analysis is a poor method for deciding on the timing of a trade, what will you, the trader, use to define your entry and exit points? Which method will allow you to decide when to take a profit or accept a loss? This question leads us to introduce the subject of technical analysis. Read more about fundamental analysis.

Forex Technical Analysis

Published:Updated:

The beginnings of technical analysis is usually dated to the Dow theory, and to the early part of the 20th century. Over the years, many contributors have created indicators, oscillators and moving averages of all sorts to increase the arsenal which the trader can utilize to understand the forex market. But the basic principles of technical analysis have remained the same:

- Prices discount all available information

- Prices trend (in other words, price movements are not random)

- Historical data is useful for predicting future developments

As noted previously, technical analysis is useful for analyzing price patterns that emerge as a result of global economic activity. Thus, it’s different from fundamental analysis: Its effectiveness is greatest when market participants are the most emotive; the total turnaround in the market is constant with little new money entering or exiting; and economic fundamentals are of short-term value only.

This may perhaps appear counterintuitive to what many have come to believe over the years. But in fact, those who are most successful in using technical analysis are those who follow the long-term trend, and the long-term trend is merely another name for what is called the “big picture”, as painted by fundamental analysis.

Technical studies are useful for determining entry and exit points, because the information provided by fundamental analysis is too vague when it comes to price and quotes. While not precise, technical analysis does provide the trader with a number of tools for determining points of action, and the trader can use any method that he feels comfortable with, provided he knows what he’s doing.

On a final note, although the new forex trader may perhaps be overwhelmed by the vast number of indicators and such that are available for his use, the good news is that only one from a each type of indicator will usually provide all the data necessary for trading. Later, we will examine indicators in detail. For further reading: see our extensive section on technical analysis.

Summary – Forex Analysis

Published:Updated:

Needless to say, any method that works is a good method. Conversely, any trading method that fails — however convincing the arguments behind it — is useless. While this is so, it’s often hard to characterize what success or failure is for a forex trader. A trade that was a failure when it was closed can easily become greatly profitable for you a short while later, and vice versa. Many times the losses suffered by forex traders are caused by emotional problems related to a lack of knowledge or confidence, rather than any flaw of the method used. Thus, when determining which method you would like to use and how to use it, you must first determine your own goals and capabilities, so you can choose the most suitable method for your trading goals.

It’s quite clear that for long-term, investment-minded traders, fundamental analysis offers the greatest potential return over a long period of time. Those who focus on fundamental analysis will be able to ignore the day-to-day fluctuations in the currency markets, and will also be able to avoid the pitfalls associated with whipsaws and similar sudden and unexpected movements. However, doing so requires a great deal of patience and emotional resilience — not to mention a significant investment in time and energy – before you have enough confidence in your skills, and can ride through the sometimes scary corrections and counter-trend movements. To be sure, the trader can gain the necessary confidence through study and patience, which means that success in the forex market requires no special talent or intellectual genius.

For short term investors who want to get into the thick of the action in the market and make sense of the nonsense out there, technical analysis is obviously the best tool. Those with experience in forex trading know only too well that in the short-term, even the most convincing news releases or statistics might fail to move the market in the anticipated direction, and in some cases, the market may react unfathomably to fundamental factors. Technical analysis is the tool of the financial rodeo rider, who wants to tame the raging beast of the markets, and we can only admire him for his courage and be astonished at his success when he achieves it.

Trading Styles

Published:Updated:

What is a trading style? It’s simply what a trader or speculator enjoys or feels most comfortable doing while interacting with the market. They can be valid for both long and short term trading, and for different styles different indicators and technical patterns have greater significance. Nonetheless, we should always keep in mind that the market is not bound to submit to our choice of style. The day trader could easily find himself in a swing trading situation, and the swing trader may end up following the trend, depending on how the market decides to behave.

What is the proper style for a beginning trader?

There are in fact only two types of trading: long-term and short-term. While the beginning trader is excited about his “debut”, and desirous of maximal profits over a short period of time, the fact is that at his level of experience and knowledge, he’s the least suited to a short-term trading method. Because of the shorter periods of exposure to the market’s whims, scalping or day trading may sound like the surest ways to success for the beginner. But, because the market’s behavior is more or less random in the short term, the habitual day trader or scalper may in fact be exposing himself to much greater risk by minimizing foresight and predictive capability. It’s hard to know what the next move will be when dancing in the arms of the bipolar short-term market.

The beginner may benefit from some short-term, very low-risk trading activity to gain understanding of the various trading concepts and tools of technical analysis. But, as soon as he’s willing to embark on serious activity, he’d be well-advised to focus on trading psychology, rather than trading style.

Of course, once the trader feels confident that he knows what he’s doing and has a reasonable amount of experience and knowledge about the markets, he can make his own choices about which trading style, which indicators and which currency pair he’s most interested in trading. But, it’s important to keep in mind that the best style is a flexible style, and that adaptability and humility are better than any preconception about the kind of trader we’d like to be. Let the market make the choices. How much control do we have over its decisions, anyway?

Let us take a look at the several different kinds of trading styles for short term activity.

Forex Day Trading

Published:Updated:

Forex day trading is the style of the short-term speculator. The reasoning behind a day trading style, is that there are times when exceptionally fast market developments allow exceptional profits in a very short time. Day traders in general will not hold a position for more than a few days, and the best among them are alert, quick, decisive and disciplined about what they want from the market, and the ideal conditions for a trade.

This method requires that the trader be nimble, and that he flee from danger like a rat, and chase opportunity like a cheetah. Needless to say, such speed and alertness require strong nerves and will from the trader, and it’s crucial to know where and when to act without hesitation when the decision is made. Successful forex day traders have, in fact, predefined expectations from the market, and they will only react to the “perfect” scenario, where the conditions are ripe. Indeed, there are circumstances where a quick profit can be made by quick reaction to incoming data. The bull market of the 90’s was an exceptionally lucrative time for day trading stocks, as initial public offerings allowed massive profits to be made through the indiscriminate daily purchase of new firms.

Forex Swing Trading

Published:Updated:

Forex swing trading is a form of range trading. The swing trader attempts to capitalize on periods of market indecision, and aims to make use of support and resistance lines, channels and price patterns such as tops and bottoms in formulating his strategy.

This style offers greater odds of success for beginners, learning to trade forex, as it doesn’t limit the trader’s attention to a couple of hours (unlike day trading), and because the swing trader doesn’t need to invest a lot of time trying to identify the perfect price for entry and exit. As long as the price remains within the range identified, and the periodic reversal patterns persist, the trade will return a profit. When the range breaks, the swing trader has no illusions about what he must do. His period of bounty is over; he can enjoy his profit and rest as he awaits the next suitable period.

Needless to say, the main requisite for successful swing trading, as with trend following in general, is the correct identification of the range or trend. In doing so, the employment of both fundamental and technical analysis perhaps offers the greatest rewards, but the trader will usually choose the method that he favors the most. In either case, gaining a good understanding of the type of market experienced for a particular currency pair and formulating a defined strategy on that basis is the best course. As previously mentioned, the swing trader does not need to be precise about the entry and exit points; all he needs to do is catch the main movement, taking profit as soon as the price action runs out of speed at a point close the limits of the range identified.

Forex Scalping

Published:Updated:

Forex scalping aims to make use of small price movements and the bid-ask spread in order to turn a quick profit in a short time. Although each profit is naturally small, significant sums may be gathered by persistent trading.

The most basic form of scalping is the usage of the bid-ask spread. The scalper attempts to make a very quick profit by exploiting this gap during periods of price fluctuations. As volatility causes the bid-ask spread to widen, the scalper moves very quickly to turn the price movement into profit. There are other traders who don’t utilize the bid-ask spread, but generally trade very small sums for very short periods with the hope of patiently accumulating gains over a longer time period.

Scalping can be a relatively low risk method for the consistent and disciplined trader who knows when to cut his losses and is cautious about taking only the trade that meets his predefined standards. Successful exploitation of the bid-ask spread can be especially fruitful, but it depends on the ability to avoid periods of stress and volatility in the markets. At times of great stress, the bid-ask spread can rapidly widen to unexpected levels and the stop-loss order placed by the scalper may rapidly lose its significance, wiping out the gains of considerable past effort. The scalper must have clear goals, discipline and acquire time-tested money management skills in order to avoid being swallowed when the market turns nasty. For further reading on scalping, read our extensive guide on the subject.

Conclusion – Which Style Should You Choose?

Published:Updated:

None of these trading styles offer an unblocked path to success, or a sure way to doom for the trader; the successful trader can choose any method he feels comfortable with. If he adheres to the basic principles of money management and risk control, education and experience, coupled with emotional discipline will be all he needs for a successful career. Most importantly, prudent risk management will ensure that even in the case of failure, the trader will suffer only as much as he deemed tolerable, and the loss can even be considered the fee for the lessons learned, and the enjoyment or excitement derived from participating in the dynamic markets of forex.

Trading styles are useful in showing the many diverse approaches to trading. In that sense, it’s likely that the beginning trader will eventually develop his own style in time, and there’s no reason to assume that such a style will be inferior to the ones we discussed above. Let’s repeat our mantra once more: No indicator, no style, no method, no forex robot or technique will offer the sure path to success in the markets. Success is only achievable through study and discipline. When choosing a method it’s most important that you give foremost consideration to your own character, experience and knowledge, instead of worrying about the particularities of the method itself. In any case, the generalizations we outlined above are only valid for educational purposes: There’s no such thing as a pure scalper or a pure day trader. As mentioned before, flexibility in adapting to the market while not giving up discipline in managing our assets and risk is one of the prerequisites of a successful trading experience.

Technical Analysis

Published:Updated:

In a previous chapter in our forex training course, we discussed what technical analysis is. In this section, we’ll take a look at the various indicators and patterns that are used in technical analysis.

The most basic tool of the technical analyst is the chart which depicts price action during a specified time period. Charts are useful for giving us historical information, and they can provide a snapshot of the market at the moment they are drawn.

Let us look at the two main types of charts according to how they depict price movements:

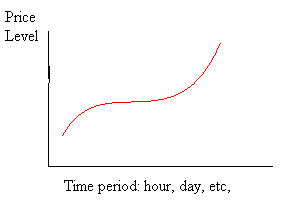

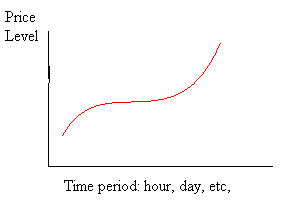

Line Charts

The line chart is simply a graph of price points connected by lines. The vertical axis, as shown in the symbolic chart below, depicts prices, and the horizontal axis matches a particular time to each price quote on the vertical axis. Line charts are pretty simple and straightforward and the trader will have no difficulty in getting used to them with a tiny amount of practice.

The advantages provided by line charts are in clarity and simplicity: instead of cluttering the vision with highs, lows, opens and closes, the line chart gives a historical picture of the underlying trend, and the trader is free to make his interpretations. The line chart is perhaps best used to supply the trader with a basis on which he can build his trading strategy. Once he’s got a grasp of the underlying movement, he can use other, more detailed charting tools to precisely define where and when he will move to make a trade.

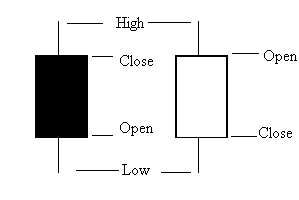

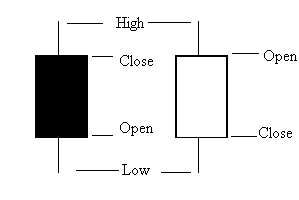

Candlestick charts

By the standards of technical analysis, the candlestick method is ancient. Its origin is thought to be 18thcentury Japan, and legend credits a certain Homma Munehisa with its invention.

The candlestick chart packs a lot of information in a very concise and useful form: Let’s see an example in the graphic below:

The black candlestick signifies a market session that closed on a higher price quote. Conversely, the white candlestick tells us that the prices closed lower. The body of the candlestick shows the open and close values (when depicted on a price chart), and the top and bottom edge of the wick shows the highest and lowest values for the session.

Let us see the various types candlesticks the trader can encounter on any chart:

- Hammer – a bullish pattern during a downtrend (long lower wick and small or no body); Shaven head – a bullish pattern during a downtrend & a bearish pattern during an uptrend (no upper wick); Hanging man – bearish pattern during an uptrend (long lower wick, small or no body; wick has the multiple length of the body.

- Inverted hammer – signals bottom reversal; Shaven bottom – signaling bottom reversal, the hammer has no lower wick; Shooting star – a bearish pattern during an uptrend. The candlestick has a small body, a long upper wick, and a small or non-existent lower wick)

- Doji – the candle body is squeezed to a thin line, neutral signal.

- Long legged doji – signals a top reversal

- Dragonfly doji – when there’s no upper wick, and a long lower wick, the candlestick signifies a trend reversal to the bullish side.

- Gravestone doji – when there’s a long upper wick, and no lower wick, the candlestick signals a trend reversal to the bearish side.

- Marubozu white – no wick, depicts a beginning or continuing bullish trend.

- Marubozu black – no wick, depicts a beginning or continuing bearish trend.

Next >> Resistance and Support >>

Previous << Which trading style to choose <<

Resistance and Support

Published:Updated:

Resistance and support lines are price levels which temporarily halt or reverse the continuous movement of the trend. When the trend is bearish, support lines are created where sellers are temporarily (or sometimes permanently) exhausted and cannot press the quote any lower. Conversely, during a bullish trend, the price level where buyers are checked is called a resistance line.

Why the resistance and support lines work well

Studies over the years on technical analysis have confirmed resistance and support lines to be performing relatively well in their predictions. There are a number of reasons for this:

- Resistance and support are relatively easy to identify on charts. From the most seasoned analyst to the forex freshman, traders don’t have a lot of trouble identifying and drawing support and resistance lines. In consequence, there’s little disagreement about their location and interpretation, unlike the case with Fibonacci retracements or MACD where different starting points or different parameters can result in different results. Such is not the case with support and resistance lines, which are easier to identify and interpret.

- Support and resistance lines often receive a lot of attention from news sources like Bloomberg or CNBC. The public is led to identify a particular price as a “decisive” or “key” level, and when it acts accordingly, the significance of these levels is easily established. The influence of the financial media in raising awareness of these price points is so great that even those who have little interest or understanding of the forex market can’t avoid noticing the erasure of these levels.

- Finally, support/resistance lines are not just imaginary lines drawn at the whim of the analyst. Multi-year, multi-month, multi-week support and resistance are often defended by large order clusters sometimes originating from sovereign actors (in other words, central banks or their equivalent). A few large banks such as Deutsche Bank, UBS and JPMorgan have an enormous dominance in terms of forex transaction volumes, and it’s hard to imagine a support or resistance line holding without their participation. Not only do these large firms have access to their own clients’ orders and allocations, but they also can move prices in either direction in relatively calmer markets by simply placing orders. Their orders and choices are thus noted by market participants at large, and contribute greatly to the establishment and validity of the concepts of support/resistance lines.

Definition of resistance and support lines

So what is a support or resistance line? To understand this, let us first consider how a price quote is created, as countless orders flow each day across computer screens and phone lines around the world:

When a dealer enters a buy order, the broker has the order filled by executing as many offers as possible until the amount the customer desires is reached. If the original order is a large market order, the broker will keep climbing on the price ladder until the order is fulfilled. Support and resistance points are created when the total orders in the market are not enough to clear the offers at a particular price level. When the orders are sell orders, and there are more than enough buyers at a particular price to exhaust the sellers, that price level is called a support; when there are more sellers than the buyers’ orders can clear, the price level is a resistance.

Technical analysis has an equal but different-sounding explanation of this concept. Instead of order flows and their fulfillment and exhaustion, technical analysis simply notes when a price level fails to be exceeded in either direction, and once that price is visited again, the analyst will warn of support or resistance at that level. The rationale behind this suggestion is provided by trader psychology: Since many participants expect a price level to resist or support the quote, that price level will act in the anticipated manner regardless of what the other variables suggest. In a sense, technical analysts claim that traders behave like pack animals.

During the course of an ordinary trading day it’s possible to identify innumerable support and resistance levels on charts of different time frames, and in many cases, support and resistance lines are indeed created for no other reason than that traders expect them to exist. But while this is true, how much can the rational trader benefit from this concept when it is based mostly on emotional responses?

Remember that emotional reactions are unpredictable

Let us once more remember that we as human beings can only evaluate our environment through our brains. It’s always possible to predict the rational response to any event provided that one is in possession of the relevant data. But it’s far more difficult to predict the emotional response of anyone to any event, however abundant the data may be. There are countless examples of collective mania throughout history, from the Holocaust of the 20th century to the Crusades of the 11th century and beyond. Emotions such as fear, hate or anger can cause humanity to behave in all sorts of unpredictable ways. So, on what basis can we claim to understand the mass-emotions of the markets through indicators such as the resistance and support levels?

If this is the case (and we can’t really make such a claim), we’re faced with a question that we must somehow have already answered: What will be our criteria in determining which support or resistance line is trustworthy, and which one is not?

How to determine which lines are trustworthy

In general, traders should not try to wager a bet on the strength of any support or resistance line without the presence of data on order flows. Information on the order flows of central banks and other major financial institutions is often provided by financial news providers, and a forex broker will usually provide his client with news flow from at least one such source. As a particular support/resistance line fails to be breached a number of times, the names standing behind that line will be clearer. More importantly these large actors often have easily discernible motives behind their actions. Their behavior patterns become identifiable, and the patterns last longer than those of speculators. Consequently, their behavior is far more predictable than those of the smaller speculators.

The support of the Russian Central Bank for the Euro during the past years, for instance, was well-known to forex markets: In countless cases their appearance behind a price level was enough to sustain the market or change its direction. Many such examples can be given about the relationship of the UK’s pound with Middle Eastern central banks and their equivalents and that of the yen with Japan’s exporter-related accounts. A trader would often make a profit by siding with these actors when their presence was acknowledged. And if he didn’t know about their existence, he’d simply not take a position based on support or resistance. While some of these institutions will not be as powerful in the coming years as global trade and commodity markets cool down, the relationship between support and resistance lines and the large global financial actors will probably remain the same.

Now of course, there will be those who will rise up and rightfully attempt a rebuttal of our argument by pointing at the intra-day resistance level that failed to be breached three, four or five times, and held its own in the absence of any fundamental reason to justify its strength. And they will say, “Alright, so this resistance level was created by emotional responses, herd behavior, trader psychology, and so on, there were no large players, but what is so wrong about that? Ok, we can’t explain it, we can’t know the reasons that caused it, but we can still make a profit from that, right? So, maybe you should just shut up, and tell us how to do so.”

To this argument the response would be that the strength or weakness of the support and resistance lines that seem so clear to the person who wishes to profit from them, is only clear in hindsight: For every support line that holds four times, there are many that failed the third time. And for every resistance line that was unbroken three times, there were many that failed the second time. They all look good and profitable on the charts, but what will allow us to know which one will hold and which will fail? Since in a majority of cases the anticipated support and resistance level will fail, how are we going to decide which one will hold and which one will not?

Of course, this is not suggesting that the concepts of support and resistance are useless; quite the contrary, they have been proven to be meaningful and relevant to trading through research and experience, but we only submit that the trader look beyond the price action itself in establishing the validity of support or resistance lines.

Conclusion

To conclude, let us admit that no sane person of any knowledge of the forex market will deny that emotions play perhaps the greatest part in the formation of intraday and daily quotes. It is rarer that the emotional responses of traders dominate trading for months over realities, but it is by no means unheard of, or extreme. The problem on a trading method based on emotions is not in the method itself, but in the unpredictability of human emotional responses.

Previous << Forex Technical Analysis <<

<< Back to the beginning of the forex course <<

Updated:

Price Action: Chart Patterns and Price Formation

Published:Updated:

As we noted previously, technical analysis concerns itself with the patterns created by the price quote changing throughout the day and beyond. Through the last century, studies of stock prices have supplied traders with valuable tools for evaluating those price patterns. (click here to see one of the most powerful price patterns) Triangles, tops, bottoms and so forth are no less valid in analyzing forex than they are for the stock market. There are a large number of them to be found in trading-related books and publications, and their recurrence through all sorts of different markets proves their relevance.

While using these patterns traders must always keep in mind that at any moment any unexpected event can easily disrupt a perfectly developing pattern. Indeed, in the currency market, they are very often derailed by large orders submitted for very mundane reasons: the managing of an overdue position, closing of a deal, etc. In general, it is not advisable to base one’s entire trading method on these patterns, but they do provide an excellent early-warning system for identifying a potential trade, provided that it’s backed by good causes supplied by other aspects of analysis.

The character of these patterns is the accumulation of tension and its eventual release. As we’ll see, most of these are created when the market is unsure about where to go, and is unable to break out of a particular range during a period of indecision until the crucial information is provided, uncertainty is removed and the price is free to move. The lacking information may be supplied by a news release, a government announcement, a press conference, and through myriad other possibilities.

In general, the best way to utilize these patterns is to seek them during periods of uncertainty, identifying their cause through fundamental analysis, and acting on the result.

Let’s see a few examples:

Symmetrical Triangle

The red line here depicts the price quotes, while the blue area is, obviously, the triangle. As it can be seen from the basic graphics above triangles represent periods of consolidation; in other words, the market is going nowhere.

Triangles are in general thought to be continuation patterns: The time frame during which they develop is often a period where the market digests the previous developments, absorbs new money and awaits new data that will provide it with the trigger to continue in the previous direction. So in essence, triangles are the breather phase in a continuing run during which market participants pull back and reassess their gains or losses. At the point where a triangle develops, the market usually has not entirely priced in the main event which created the bull or bear market in the first place, and triangles can be a good entry point for a trader who has missed the beginning of the main trend, provided that the underlying fundamental picture remains the same.

The symmetrical triangle represents the case where the market is temporarily unsure about pressing the price higher or lower beyond the range established. It is thus often found on intraday charts in the period leading to major news releases. Neither money flow nor news supplies the catalyst to move the market to either direction, and the vote of the market is split. Still, the symmetrical triangle can provide a very good point for joining an existing trend, provided the fundamental picture remains the same and there’s no major development that can alter the direction.

Ascending Triangles

The ascending triangle represents market conditions during which the market participants are inclined to view the bullish aspect more positively. In other words, the amount of money that is buy-side is greater than the amount that is sell-side, but the difference between the two is not enough to force a breakout from the triangle pattern. It’s a sign that given a sufficiently positive signal from news flow or the infusion of a large amount of money into the market, prices will either continue or begin a new uptrend.

Traders usually interpret the ascending triangle during a bear trend as a sign of trend-reversal. It’s safe to say that it is at least a sign of indecision or exhaustion by market participants, just like all the chart patterns that we examine here. As with the symmetrical triangle we just discussed, it can provide the trader with a good entry or exit point, provided that the signals sent by technical analysis are confirmed by sound fundamental reasons. For those who’d like to base their decisions on technical analysis only, a well-planned stop-loss order is advisable, as the breakout of all triangles can be rapid and violent, causing great losses to those on the wrong side.

Descending Triangles

The descending triangle is the exact opposite of the ascending triangle. As a result, it’s usually found at reversal points in bull markets but also as continuation patterns during the course of bear markets. All the statements made above about the ascending triangle are also valid here, but in reverse.

Despite all the characterizations that we’ve made about these patterns, we must always keep in mind that nothing in technical analysis is guaranteed. There’s not a single indicator or pattern that offers the trader the perfect solution to the market’s uncertainties.

Double, Triple and Quadruple Bottoms and Tops

Tops and bottoms are patterns that are found when the trend is in danger of reversing. During the development of these patterns buyers and sellers are close to being in equilibrium, and the amount of money entering or exiting the market is not enough to force a breach of the support and resistance lines that define the top and bottom structure. In other words, the main trend that is being tested at the support or resistance line is in danger of exhausting itself, but is still intact as long as the pattern is developing. As with the triangle pattern, this pattern keeps zigzagging and repeating itself until news or new money forces a breach of the support or resistance level. Technical analysis contends that the greater the number of tops and bottoms, the higher the likelihood of a reversal; the stronger a support or resistance level is, the higher its potential for overcoming and reversing the trend, at least on a temporary basis.

Of course, not every top/bottom formation will lead to a reversal. In fact, as with the triangle, these formations occur ubiquitously on the intraday and intra-hour charts without having much significance beyond signalling a very brief period of consolidation for the price action. But there are times when the tops and bottoms are strongly coupled to news reports and other fundamental developments, and the trader will surely come across many cases where the market responds in quite a predictable fashion to the stimulation provided by these sources. In order to avoid whipsaws and false breakouts, the trader can always attempt to corroborate his technical scenario with information from the fundamental side.

Head and Shoulders and Reverse Head and Shoulders

Head and shoulders patterns are in fact quite similar to top/bottom formations, with the one distinction that the second attempt at breakout (that is, the head) from the support or resistance level where the first shoulder failed is able to succeed, but then goes nowhere. In other words, the trend temporarily seems to press on with its progress, but the price movement is deceptive, and eventually the prices move back below the support or resistance line where the shoulders of the formation fail to breakout again. The trend is then expected to reverse.

The head and shoulders pattern is in general a reversal signal in a bull market, while its reverse signifies the opposite. In a sense, the market “eats” those few who, on a bout of euphoria, follow the false breakout and attempt to chase it higher, while the majority remain on the sidelines, undecided. Once it’s clear that the breakout attempt has failed, they make their own move, and the trend is reversed.

The pattern is a powerful signal and should always be considered when evaluating the price action. Of course, it’s not the compass for determining trend reversals, but it’s a significant and useful warning sign for a possible change in the market’s attitude. Find our most comprehensive article on different well known chart patterns here.

Next >> Technical indicators >>

Previous << Resistance and Support Signals <<

<< Back to the beginning of the forex course <<

Updated:

Updated:

Technical Indicators

Published:Updated:

Technical indicators are utilized by traders in the same way that price patterns are. In the case of indicators the purpose is to give the chaotic jumble of prices and quotes some resemblance of order through the employment of simple mathematical tools. While the idea of engaging in mathematics may sound intimidating to many at first, all of these indicators have been standardized through the years, and the trading software that draws them will in general leave little discretion to the user. The mathematical formulas themselves are usually simple and straightforward, and some high school mathematics is the most that is needed to understand why and how are they are constructed.

How many indicators should we use? Which indicator is the best for evaluating a chart? These are the questions that often confuse the inexperienced trader, and leads the experienced trader to claim that trading is an art and not a science.

Let’s try to answer those questions one by one:

How many indicators should a trader use?

The answer to this is not as difficult as it seems at first glance. It can’t be denied that the more indicators there are on the computer screen, the more information is available for the trader. Moving averages of different time periods, for instance, can provide a good signal for determining the next obstacle, the next support and resistance levels for the price.

But the question is, how much information does the trader need? Does he aim at making quick profits on an intraday basis? Or, does he aim at making profits from monthly movements? Obviously, a long term investor has very little use for a 3-hour moving average.

And beyond these questions, how much information is the trader able to evaluate meaningfully before losing focus and being lost in meaningless mental discussions about whether this or that indicator gives the right signals?

Naturally, people will have differing answers to these questions based on personal experience, and there’s nothing wrong about that, as many of the indicators themselves are the same tools disguised in slightly differing formulae. It’s very hard to decide whether the RSI or Stochastics is more accurate in giving signals, but it’s not that hard to claim that what they do is by and large the same thing.

Simplicity and clarity, as in everything else, are the best pieces of advice that a beginning forex trader can pocket from this discussion.

Which indicator is the best for evaluating a chart?

To this, the answer is rather simple: none. While it’s true that for different types of charts, different types of indicators can have more significance (such as the RSI being more suitable for ranging markets), the best method probably is taking one of each type of indicator (oscillator, moving averages, and so on) and combining them to get as complete a picture as possible about the current state of the market through the use of technical analysis.

Let’s briefly examine the four major indicator classes most often encountered in forex:

1. Oscillators

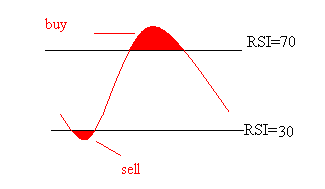

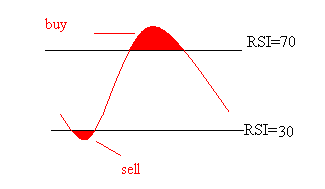

The relative strength index (RSI), or Stochastics are called oscillators because they move back and forth (oscillate) between two fixed points. In general, the forex oscillators move back and forth between overbought and oversold levels, and the signals they generate are most useful in range-bound markets. To give an example, the most popular and common of oscillators, the RSI, will give a buy signal when the indicators value is below 30, and a sell signal when the value is above 70.

Most charting software provided by forex brokers include the capability to plot all kinds of oscillators on the price. Since oscillators of the same kind can give conflicting signals, it is perhaps a good idea to use only one oscillator in evaluating a single chart. In fact, since a large part of the perceived effectiveness of technical tools is the result of their wide-spread usage by traders, it’s not advisable to use a rare, obscure technical tool, however convinced the user may be of its effectiveness.

Oscillators are leading indicators, in that they’re supposed to give advance warning of a change in the direction of the price movement. How valid the signals they give are depends on the liquidity of the market and price pattern. In an environment of poor liquidity (like Christmas week, when most people are on vacation), the signals emitted by these indicators are likely to be almost useless, because a sudden and relatively small injection of liquidity is highly likely to disrupt the oscillator’s scenario. Similarly, in a strongly trending market, the RSI can touch 70, 80, and even higher levels without the much anticipated counter-trend movement materializing. Learn more about oscillator indicators.

2. Moving Averages

We have mentioned several times that the price movements on a typical day are chaotic and unpredictable. The purpose of the various kinds of moving averages is to smooth out those fluctuations, and to provide the trader with a more easily evaluated picture of the trend. Moving averages can also be said to identify trends automatically: While in drawing trend lines, the trader has to use a lot of discretion in deciding which price movement is significant and which is not — the moving average simply takes all the available data and creates the trend.

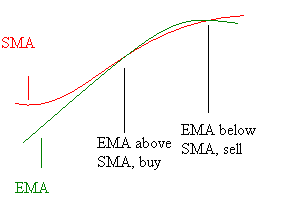

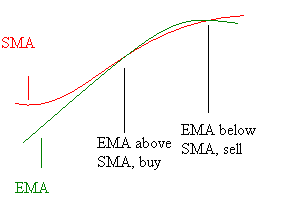

The two most usual kinds of moving averages — simple and exponential — are calculated in a similar way, but with one little difference: The simple moving average adds all the closing prices together and divides them by the number of the periods (days, hours, etc). As data is updated, the average changes (that is, moves) and the indicator is thus plotted out on our screens. In calculating the SMA, all the data from different time periods are weighted equally: Yesterday’s price is just as important as the closing price of three months ago. But in calculating EMA (exponential moving average) a simple mathematical formula grants greater value to the prices of the most recent time period, and therefore recent values are emphasized.

There are many ways of making use of these indicators. For illustration purposes we’ll consider the moving average crossover method which is often used for determining entry and exit points.

Because the EMA values the most recent periods more, and thus is more sensitive to recent price changes, the trader using the crossover method will use those occasions when the EMA makes an outsized movement in either direction in comparison the SMA as entry and exit points. That is, when the EMA moves faster than the SMA, and crosses below or under the SMA line, the trader will make an attempt at opening a position if all his other conditions (fundamental, technical) are also met. More about the simple moving average. More about the exponential moving average.

3. Pivot Points

Pivot point are calculated by taking the average of the previous high, low, and closing prices, but as with most technical indicators, there are a lot of different ways and approaches to calculating them. Fortunately, as forex brokers provide charting services that perform these calculations in place of the trader, all we need to discuss here is how technical analysts use pivot points to predict future price movements.

Technical analysis contends that if the pivot point is broken in an upward direction, the short term signal is that a new trend is being established, or at least that a short term bullish movement is underway, and vice versa if the pivot point is broken in the opposite direction. Another usage of the pivot point that we must mention is in determining the trigger point for a new trade or limit/stop order. Since the pivot point is considered the most important support and resistance point, it can be utilized as profit taking target, or a convenient price level for a stop loss order.

Pivot points are short term indicators, and must be updated each day with the incoming data. All other things being equal, the technically-minded trader will expect the greatest price fluctuations to occur at the pivot point, and the other technical support or resistance levels are expected to be of minor significance in comparison.

4. Fibonacci

Fibonacci numbers, discovered in the 15th century by an Italian mathematician, are numerical patterns found throughout the nature in everything from the structure of leaves to patterns of sea waves.

But we’re only concerned with this mathematical curiosity in as much as it bears on our trading experience, and that’s where we’ll need to consider the Fibonacci retracement and extension levels.

Fibonacci retracement occurs when the market reacts to a price movement in the course of a trend with a movement on the opposite side, with the size of the opposite movement defined through multiplication with the Fibonacci numbers of 0.38, 0.5 and 0.61. These levels can be drawn by the charting software offered by the broker, and the trader should only know the existence of the various levels and their significance in determining the size of the usually temporary reversals. Fibonacci extension is the opposite of retracement: During the course of a continuing trend, the size of the next leg of the trend can often be calculated by multiplying the size of the previous leg with one of the Fibonacci numbers.

The reader should not worry at all if that description sounds complicated. The best way to learn about extension and retracement is practicing on the charting software with a game or mini account offered by the broker. All that you need to keep in mind is that the size of the extension or reversal is only clear in hindsight: There’s no way of knowing which of the three Fibonacci numbers we mentioned above will determine the size of the oncoming reaction or continuation.

Next >> Fundamental Analysis >>

Previous << Chart Patterns and Price Formations <<

Fundamental Analysis

Published:Updated:

Fundamental analysis concerns itself with the causes of price movements. It doesn’t attempt to predict future price movements per se, but because economic events move far slower than market developments, it’s usually the case that a phenomenon established by fundamental analysis will be valid for a longer time than the market reacts to it, and discounts it (due to the market’s erratic, irrational and emotional behavior), and it’s this fact that the trader exploits for profit.

What is fundamental analysis?

Fundamental analysis is about economy and politics. It is important to keep up-to-date about weekly employment statistics, consumer price inflation, interest rates and similar “hot” indicators that are at the forefront of newspapers pages and TV screens, but just being aware of them and expecting the market to react to them in the desired fashion in a short time is not fundamental analysis, nor is it common sense. In fact, as we mentioned in the earlier paragraph, the main reason that the trader can profit through fundamental analysis is that the markets do not react reasonably to fundamental developments.

Let’s illustrate our point with an example:

Until the autumn of 2007 the US had very low unemployment: Toward the latter part of the second presidential term of George W. Bush, unemployment in the US moved below five percent, and it remained at those levels for a considerable time. Most of the data released through this period remained positive overall, with the exception of the housing market, where conditions had been deteriorating since 2005.

Thus, most of the data and news releases were positive, and if we’re seeking to show that fundamental analysis provides good guidance to the trader, it’s clear that we do not have that guidance in the patchwork of numbers that attracted the most of the media attention. Focusing on the news releases, without placing them into a working context, without understanding the workings of the economy, the trader is as blind as the proverbial blind man who tries to describe an elephant by a few gropes at its feet, the tusks and the trunk.

How do you become successful with fundamental analysis?

Like most good things in life, being successful in performing fundamental analysis requires study and patience, but once again, there’s no expectation of exceptional skills from the trader. Economics is a popular field, and most of the data necessary for understanding the market is available online with research provided for free, in many cases, by big banks and government institutions. What the investor is expected to do is not to memorize the numbers and compare each week’s release to the previous one, but form a coherent mental picture of “what happens why”.

Finally, let us repeat here that most of the major fundamental events that the market appears to discount in a few days of trading at most, have in fact effects that last far longer and reach far deeper than the violent but brief reactions of price movements suggest. Interest rates and unemployment statistics are simple but effective examples for demonstrating our point: The effects of the interest rate reductions during 2000-2001 had lasted for at least 4 years in the real estate market, and had a great role in establishing the downward dollar trend that lasted between 2001 and 2008. Similarly, the trend of job creation in the US and abroad, once begun, had a deep and lasting impact on global stock prices and forex trends which went through all sorts of panics and shocks during this same period (the Iraq War, and several defaults by some large firms are good examples). In the end, however, the so-called big picture of stability supplied by high employment and low interest rates always brought the markets on track. What caused them to collapse eventually is outside the subject of our discussion. But, the fact that fundamental economic events are long-term, and that their effects last longer and are deeper than the market discounts is a fact that is not changed by all these developments.

Let us briefly examine a number of the major economic indicators used in fundamental analysis. We start off with the GDP.

Next >> GDP (Gross domestic Product) >>

Previous << Chart Patterns and Price Formations <<

<< Back to the beginning of the course <<

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Updated:

Gross Domestic Product (GDP)

Published:Updated:

Gross domestic product (GDP) is a measure of all goods and services produced inside a country’s borders. As such, it doesn’t include imports, even though imports can add to job creation and prosperity in an economy. It’s loudly discussed by all the major media outlets, and the trader needs little effort in finding and evaluating the report. There’s no need to go into the details of its calculation here, but we should briefly discuss its implications on the markets, and what a good or bad GDP number means.

GDP is valuable for the markets for a number of reasons. First, it provides the trader or analyst with a general, all-in-one snapshot of the economic situation of a nation. Without having to go through a large list of statistics, and wading through a sea of numbers to gain an overall grasp of the latest developments in an economy, the analyst finds a comprehensive report in the GDP number and its details. Second, it allows a quick and easy comparison between nations in terms of their economic prowess and health. Third, and perhaps most importantly, it tells the trader whether a nation’s economy was growing or contracting during a time period. As the overall health of an economy determines the lending policies of major banks and other financial actors, the GDP number is prone to cause periods of panic and euphoria in the market, and the patient, sensible trader can exploit these periods for his profit.

A positive, rising GDP number is a sign that the economy is growing. A positive, but lower GDP value (in comparison to the previous quarter), is a sign that GDP growth is decelerating. Finally, a negative GDP value over two consecutive quarters is usually considered a recession by economists: a period of falling demand, production, and economic activity, and a source of panic and great concern for financial markets in general.

GDP releases, along with inflation statistics (which we will discuss shortly), are some of the most important parameters that central banks use in determining their interest rate policies. GDP growth can, under certain circumstances, cause high inflation through wage growth and price rises, and central banks try to combat this development by raising interest rates (which leads to higher borrowing costs, more expensive investment, less growth and less inflation.) Conversely, a period of low inflation, or low GDP growth can lead central banks to lower interest rates with the goal of rejuvenating economic activity. Forex, and all financial markets are very responsive to changes in central bank interest rates, and the trader can keep his eyes on GDP statistics and inflation numbers as advance warning on changes in central bank policies.

Let us finally mention that fundamental “analysis” that depends merely on the headline number can sometimes be misleading. The GDP number can be flawed as an indicator of economic health for a number of reasons, but one that must be born in mind is that inventory accumulation by firms (rising stocks of unsold goods at firms’ warehouses) is added as a positive to the GDP value, and this sometimes can cause an unreasonably healthy picture to be portrayed before periods of economic slack. Since inventory accumulation can be caused by insufficient demand, the trader should always check this component of the release for anomalies before making a judgement.

Next >> Producer Price Index >>

Previous << Fundamental Analysis <<

Producer Price Index (PPI)

Published:Updated:

We mentioned in the previous section that we’d be discussing inflation, and it’s time to look at one of the two major indicators of inflation that the markets tend to watch at all times.

The producer price index, or PPI for short, is the measure of changes in prices charged by wholesalers to their clients such as retailers who then add their own profit margin to the producer’s price and pass the product to the consumer. Since the producer is at the beginning of the supply chain, under normal economic conditions where there’s healthy consumer demand and the economy is growing, the PPI can serve as an early-warning system for predicting price changes at the retailer end of the chain. The producer price index is different from the consumer price index (CPI) in that it also includes commodities and intermediate materials (such as a car engine or its components, for which the consumer has no use) and is therefore more responsive to changes in global commodity prices and manufacturing industry trends than the consumer price index.

In general, the PPI is more volatile with larger fluctuations than the CPI, and is useful only in giving a sense of the underlying price developments that are not always reflected on the consumer’s bills.

The PPI is one of the oldest indicators in existence, and its time series can be stretched back to the 19thcentury. It’s updated each month by the BLS (Bureau of Labor Statistics).

Next >> Consumer Price Index >>

Previous << The Gross Domestic Product <<

Consumer Price Index (CPI)

Published:Updated:

The second type of inflation indicator, the Consumer Price Index (CPI), has far greater bearing on the choices of policy makers (such as the US Federal Reserve), and the market in general attaches to it a far greater degree of significance than the PPI. The CPI, as a measure of living costs, has a direct bearing on interest rates, and eventually, the timing of growth cycles (in other words, booms and busts).

The consumer price index measures price changes at the retail level. It registers the price fluctuations only to the extent that a retailer is able pass them on to the consumer. Thus, in an environment of high competition and falling or low demand growth, the retailer may have to cut on his profits, and a rise in PPI may not be reflected in the price the consumer pays, as measured by the CPI.

Rising CPI signifies high inflation, and central banks in general have the goal of keeping inflation low but positive, so that the consumers’ purchasing power is not eroded. A rising, but slowing CPI defines disinflation: Prices are still growing, but the speed and intensity of price increases is slowing. Finally, a negative CPI implies deflation: A situation which often suggests that demand across the board is contracting, and the consumer can simply choose to wait for as long as he can before he buys a product. The longer he waits, the lower the price becomes.

It may sound complicated, but the beginning trader will do well by just keeping in mind the relationship between central bank interest rates and the CPI: higher CPI leads the central banks to raise rates, and as higher rates mean higher yield, the currency with high interest rates backing it tends to appreciate. Lower or falling CPI means that inflation risks have receded, corresponding to lower growth, and the central bank is free to lower rates to boost growth.